What's a REIT

(Real Estate Investment Trust)?

What assets do REITs own?

In total, REITs of all types collectively own more than $4 trillion in gross assets across the U.S., with public REITs owning approximately $2.5 trillion in assets. U.S. listed REITs have an equity market capitalization of more than $1.3 trillion.

U.S. public REITs own an estimated 575,000 properties and 15 million acres of timberland across the U.S

REITs invest in a wide scope of real estate property types, including offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure and hotels. Most REITs focus on a particular property type, but some hold multiples types of properties in their portfolios. Listed REIT assets are categorized into one of 14 property sectors

1.OFFICE REITS: Office REITs own and manage office real estate and rent space in those properties to tenants. Those properties can range from skyscrapers to office parks. Some office REITs focus on specific types of markets, such as central business districts or suburban areas. Some emphasize specific classes of tenants, such as government agencies or biotech firms.

Gaming REITs

1.Gaming REITs concentrate on owning experiential real estate assets in the form of casino and entertainment properties, and leasing them through long-term, triple net lease structures.

Industrial REITs

1.Industrial REITs own and manage industrial facilities and rent space in those properties to tenants. Some industrial REITs focus on specific types of properties, such as warehouses and distribution centers. Industrial REITs play an important part in e-commerce and are helping to meet the rapid delivery demand.

Retail REITs

1.Retail REITs own and manage retail real estate and rent space in those properties to tenants. Retail REITs include REITs that focus on large regional malls, outlet centers, grocery-anchored shopping centers and power centers that feature big box retailers.

Lodging/Resorts REITs

1.Lodging REITs own and manage hotels and resorts and rent space in those properties to guests. Lodging REITs own different classes of hotels based on features such as the hotels’ level of service and amenities. Lodging REITs’ properties service a wide spectrum of customers, from business travelers to vacationers.

Residential REITs

1.Residential REITs own and manage various forms of residences and rent space in those properties to tenants. Residential REITs include REITs that specialize in apartment buildings, student housing, manufactured homes and single-family homes. Within those market segments, some residential REITs also focus on specific geographical markets or classes of properties.

Timberlands REITs

1.Timberland REITs own and manage various types of timberland real estate. Timberland REITs specialize in harvesting and selling timber.

Health Care REITs

1.Health care REITs own and manage a variety of health care-related real estate and collect rent from tenants. Health care REITs’ property types include senior living facilities, hospitals, medical office buildings and skilled nursing facilities.

Self-storage REITs

1.Self-storage REITs own and manage storage facilities and collect rent from customers. Self-storage REITs rent space to both individuals and businesses.

Telecommunications REITs

1.Telecommunications REITs own and manage infrastructure real estate and collect rent from tenants that occupy that real estate. Infrastructure REITs’ property types include fiber cables, wireless infrastructure, telecommunications towers and energy pipelines.

Data Center REITs

1.Data center REITs own and manage facilities that customers use to safely store data. Data center REITs offer a range of products and services to help keep servers and data safe, including providing uninterruptable power supplies, air-cooled chillers and physical security.

Diversified REITs

1.Diversified REITs own and manage a mix of property types and collect rent from tenants. For example, diversified REITs might own portfolios made up of both office and industrial properties, making them ideal for investors looking to gain exposure to a variety of real estate asset types.

Specialty REITs

1.Specialty REITs own and manage a unique mix of property types and collect rent from tenants. Specialty REITs own properties that don’t fit within the other REIT sectors. Examples of properties owned by specialty REITs include movie theaters, farmland and outdoor advertising sites.

Mortgage REITs

1.Mortgage REITs (mREITS) provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities (MBS) and earning income from the interest on these investments.

How Do REITs Make Money?

Most REITs operate along a straightforward and easily understandable business model: By leasing space and collecting rent on its real estate, the company generates income which is then paid out to shareholders in the form of dividends. REITs must pay out at least 90% of their taxable income to shareholders—and most pay out 100 %. In turn, shareholders pay the income taxes on those dividends.

mREITs (or mortgage REITs) don’t own real estate directly, instead they finance real estate and earn income from the interest on these investments.

Why invest in REITs?

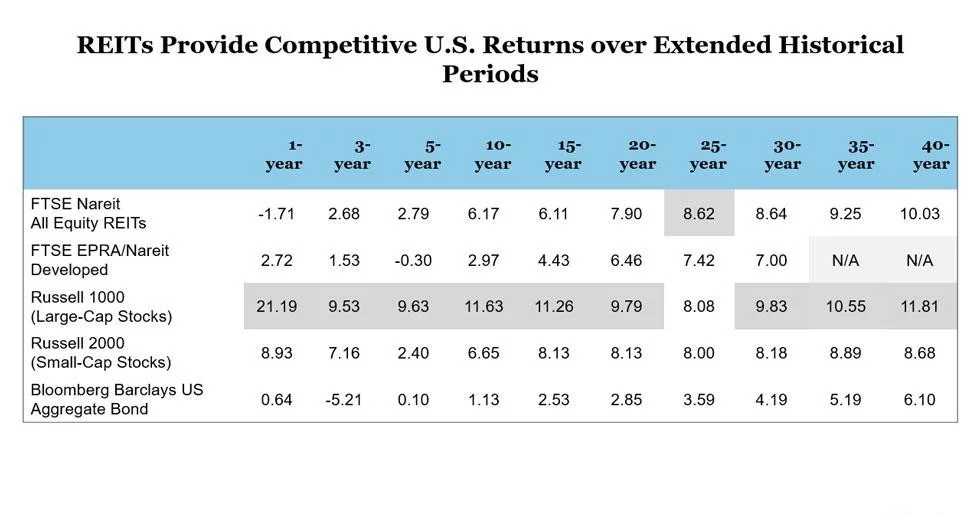

REITs historically have delivered competitive total returns, based on high, steady dividend income and long-term capital appreciation. Their comparatively low correlation with other assets also makes them an excellent portfolio diversifier that can help reduce overall portfolio risk and increase returns. These are the characteristics of REIT-based real estate investment.

How have REITs performed in the past?

REITs’ track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has provided investors with attractive total return performance for most periods over the past 45 years compared to the broader stock market as well as bonds and other assets.

Listed REITs are professionally managed, publicly traded companies that manage their businesses with the goal of maximizing shareholder value. That means positioning their properties to attract tenants and earn rental income and managing their property portfolios and buying and selling of assets to build value throughout long-term real estate cycles.

This drives total return performance for REIT investors, who benefit from a strong, reliable annual dividend payout and the potential for long-term capital appreciation. For example, REIT total return performance over the past 20 years has outstripped the performance of the S&P 500 Index and other major indices–as well as the rate of inflation.

How to invest in REITs

An individual may buy shares in a REIT, which is listed on major stock exchanges, just like any other public stock. Investors may also purchase shares in a REIT mutual fund or exchange-traded fund (ETF).

A broker, investment advisor or financial planner can help analyze an investor’s financial objectives and recommend appropriate REIT investments.

Investors also have the ability to invest in public non-listed REITs and private REITs.

How does a company qualify as a REIT?

To qualify as a REIT a company must:

• Invest at least 75% of its total assets in real estate

• Derive at least 75% of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate

• Pay at least 90% of its taxable income in the form of shareholder dividends each year

• Be an entity that is taxable as a corporation

• Be managed by a board of directors or trustees

• Have a minimum of 100 shareholders

• Have no more than 50% of its shares held by five or fewer individuals

What are the different types of REITs?

Equity REITs – represent the majority of REITs and are publicly traded. They own and manage income-producing real estate properties. In the market and within veluslimited, equity REITs are commonly referred to simply as REITs.

mREITs, – or mortgage REITs, specialize in financing income-producing real estate. They achieve this by acquiring or originating mortgages and mortgage-backed securities, earning income from the interest on these investments.

Public Non-listed REITs, or PNLRs – are registered with the SEC but are not listed on national stock exchanges.

Private REITs are offerings exempt from SEC registration, and their shares do not trade on national stock exchanges.

How does a company qualify as a REIT?

To qualify as a REIT a company must:

Invest at least 75% of its total assets in real estate

Derive at least 75% of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate

Pay at least 90% of its taxable income in the form of shareholder dividends each year

Be an entity that is taxable as a corporation

Be managed by a board of directors or trustees

Have a minimum of 100 shareholders

Have no more than 50% of its shares held by five or fewer individuals